Even if you were homeschooled and your mother was Stephen Hawking, there are undoubtedly areas in your education that fell short.

There’s a pretty good chance you learned nothing about doing your taxes, writing checks, changing your oil, or have huge gaps in your sexual education.

You can admit it. My school didn’t have science classes. We’re all morons here.

Luckily for us borderline illiterate people, we have TikTok, a completely reliable and perfectly accurate place to get all your information. The platform draws all kinds of different armchair and real-life experts in tons of topics and there is no shortage of finance tips either

Okay, so maybe TikTok financial tips should be taken with a grain of salt, but a lot of them are really good. Here are some that might help you figure out what to do with your daunting junk drawer of receipts.

1. Don’t use more than 10-30% of your credit card allowance each month:

“-Hey, have you got some money I can borrow?

-Sure, you can have up to $1,000.

-Cool, I’ll take $100, please!

-Are you sure you don’t want more?!

-Yeah, because I know if I use more than 10-30% of my allowance credit amount, you’ll damage my credit score.

-Oh, someone thinks they’re clever. By the way, you only have to pay me back $10 at the end of the month.

-No, I’m going to pay it all back in full (at the end of the month) to avoid paying any interest, thank you very much.” [watch the video here]

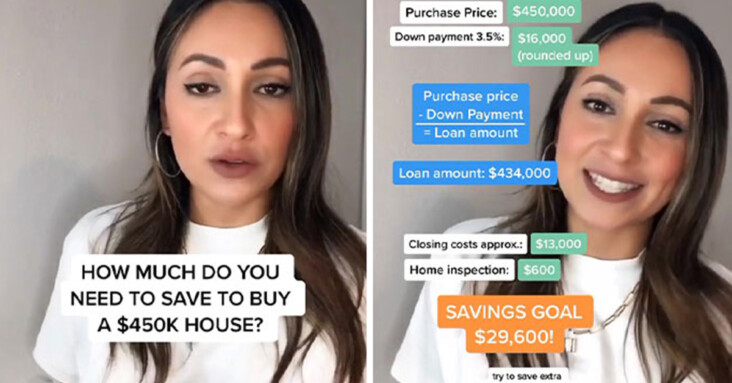

2. How much you really need to save to buy a home:

“How much do you need to save to buy a $450,000 home? This is my second exercise to help you guys understand how it’s all calculated. So if you’re buying a $450,000 home, you can still find a loan program that allows for as little as 3% to 3.5% down payment. That means for this house, you need to save about $13,500 to $16,000 to put down the very minimum, then there’s your closing cost, we know that’s about 2% to 3% of the loan amount. So let’s say you do the $16,000 down payment—that leaves your loan amount at $434,000 and we know closing costs can be up to 3% of that. That means you need to save an additional $13,000 for your closing cost. Lastly we need to add the $400 to $600 on a home inspection, so all in all, for a $450,000 home, approximately, you need to save about $29,600 to cover all your costs.” [watch the video here]

3. Find those discounts, baby!

“These are my greatest money-saving tips for broke teenagers or just people trying to save some money. Number 1, food: stop going out to eat so much and if you do go to a restaurant, do not get pop, get water and unless you’re getting an appetizer as your meal, getting an appetizer on top of a full meal is very expensive. If your friends want to go to Starbucks but you don’t want to spend money—just get water. You are a student—take advantage of that! Literally everywhere you go probably has a student discount—it is not embarrassing or weird to ask if they have a student discount. Buy your makeup at Winners, Sephora is so expensive and Winners has the exact same stuff. Get a tax-free savings account as soon as you turn 18. Ordering $300 worth of clothes that you don’t need from Shein, even though you’re getting a lot, you’re still spending $300—prioritize what you need. Have fun!” [watch the video here]

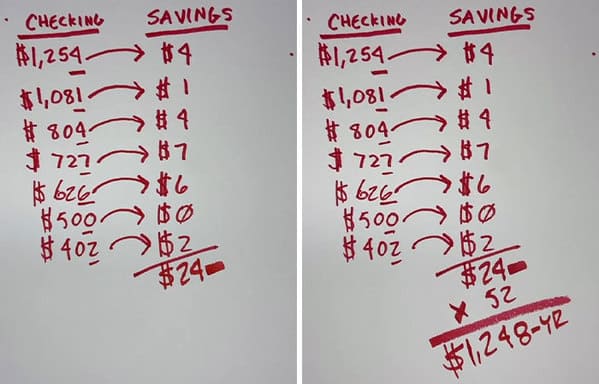

4. An understandable way to save money everyday:

“Let’s talk about an easy way to save money. This is in your checking account at the end of the day: move the last digit to your savings account. Do this every day and you barely feel it. After 7 days, I was able to save 24 bucks x each week—that’s a total of $1,248 a year.” [watch the video here]

5. Dry months will save you a ton of money:

“Dry months are an easy way to save money for other goals. 2 bottles of wine a week @ $15 each= $30 a week / $120 a month. 3 dry months in the year = $360 for a goal.” [watch the video here]

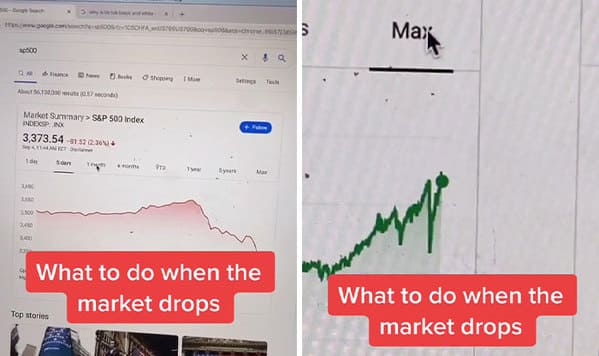

6. Be aware of the ups and downs of the stock market:

“So here’s something to keep in mind—anytime you see your stock starting to go down, when you see something like pretty bad—it sucks, go back 5 days ago, go back a month, that is still pretty bad, and then we’re about 6 months ago? Not really looking that bad, but what about 5 years ago? Wait, nevermind! And that’s what you’re worried about right now! Listen, short-term is going to suck, but long-term, when you look at the big picture, a drop like this is really not that big of a deal. It’s not that scary. Just buy the dip! And then just wait as long as possible.” [watch the video here]

7. This great tip for paying off debt:

“Tips to pay off debt. You’ve got this! Start with the one with the highest interest rate. Contribute extra money towards the principal, make your monthly payments on time. Call and ask for a lower interest rate. The hardest part will be staying consistent. Set up automated payments so you don’t forget!” [watch the video here]

8. Compound interest is really important:

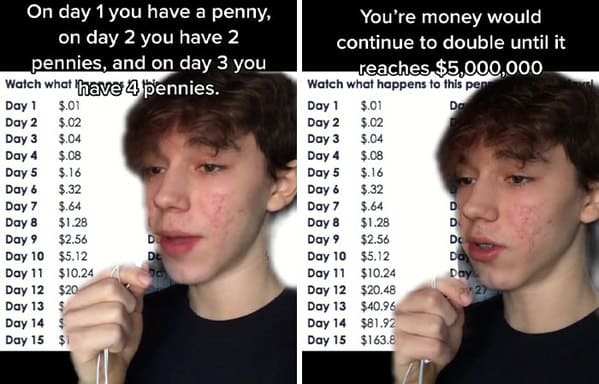

“-Would you rather have a million dollars today or a penny doubled for 30 days?

-A million dollars! A penny is nothing.

-See, that’s where you’re wrong. A penny doubled every day will make you money through compound interest.

-What’s compound interest?

-Compound interest is the exponential growth of money. It’s basically where your interest makes interest.

-Wow, you’ve lost me at exponential.

-Look, I’ll just show you. On day 1 you have a penny, on day 2, you have two pennies, and on day 3, you have 4 pennies. Your gains are making you gains. This is compound interest.

-So if I chose the penny option, how much would I have after 30 days?

-Your money would continue to double until it reaches 5 million dollars.” [watch the video here]

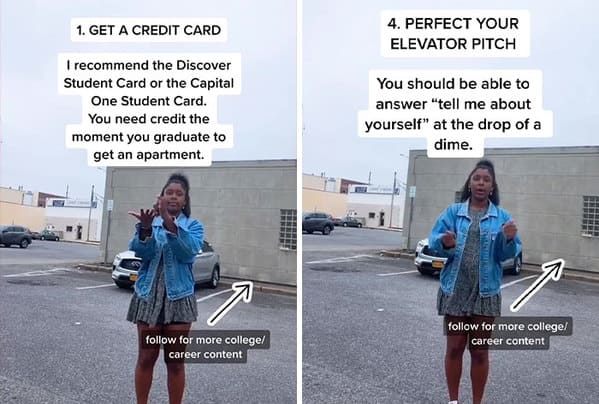

9. Figure out your elevator pitch:

“Top 5 things you should do in college to prepare you for the real world. (From a college grad who has her s*** together). 1. Get a credit card. I recommend the Discover Student Card or Capital One Student Card. You need credit the moment you graduate to get an apartment. 2. Open a high-yield savings account. Let your money make you money via interest. I recommend Marcus by Goldman Sachs or Ally Bank. 3. Open a ROTH IRA. even putting in $20 a month helps you to start saving for retirement. Use betterment.com. 4. Perfect your elevator pitch. You should be able to answer “tell me about yourself” at the drop of a dime. 5. Learn to budget. I recommend letting an app do it for you. Clarity Money is my personal favorite.” [watch the video here]

10. Things to NOT buy right out of college:

“If you just graduated college, let’s say you’re still living at home and you get your first job, a car is like, one of the worst investments you could ever make. To get a new car, which automatically depreciates, by the way, at least 10% the second you drive it out of the lot—buy a used car. Even if you buy a car that is like 2 years older than the newest one, you’re saving like 40% off there.” [watch the video here]

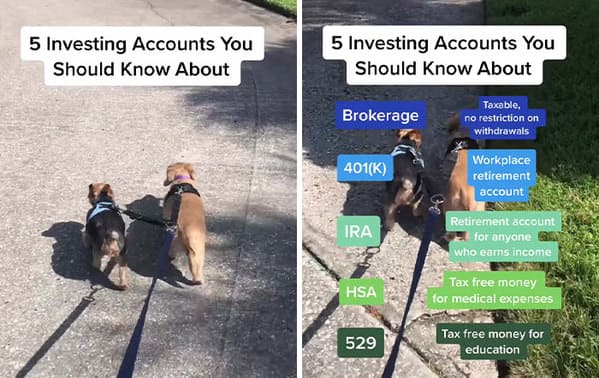

11. These huge financial tips for investing:

“5 investing accounts you should know about: Brokerage—taxable, no restriction on withdrawals, 401(K)—workplace retirement account, IRA—retirement account for anyone who earns income, HSA—tax-free money for medical expenses, B29—tax-free money for education.” [watch the videohere]

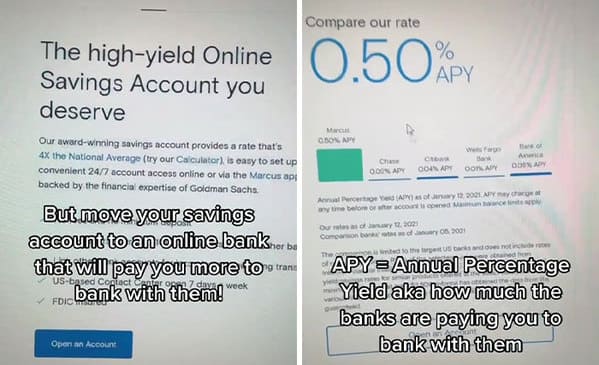

12. Learn how to get a better return on your money:

“We know we’re supposed to have a checking account and a savings account, but where are we supposed to keep these? Most people keep their checkings and savings in traditional banks like Chase, Wells Fargo, Bank of America, where they’re earning literal pennies for banking with them. You can keep your checking account with these traditional banks because that money’s not staying in your account very long to earn anything substantial. But we want to move our savings, like our emergency fund, to a high-yield online savings account like Marcus, like Ally Bank, where the interest you’re earning on your savings is 10 times the national average of a traditional bank. Like for Marcus and Ally—0.5% APY. There are a ton of these options online out there—don’t overthink them just you want to check that there’s no fees, no minimum deposit, that they’re FDIC insured—just like your traditional bank and that they have same-day transfer. Don’t sleep on these, literally everybody who you know who knows anything about finances is using one of these, so go open one today. Thank me later.” [watch the video here]

13. Understand your 401k:

“Congratulations on the new job! It’s your first day of work and HR asks you this question—are you going to sign up for the 401K plan? There’s a match. You don’t know. Don’t panic, you have time to decide, but what is a 401k? It’s an investment account for your retirement, which doesn’t mean you have to wait till you’re 60 years old. There are actually ways to get to this money much earlier, which most people don’t realize. What does an employer match mean? Here’s an example: Hi, Miss HR, I filled out all my paperwork for every paycheck and I indicated that I want 3% taken out of every paycheck and put into my 401k. Very good! And the company will match that exact amount that you’re putting in and deposit it straight into your 401k. You don’t have to pay taxes on it until the day that you take the money out. Now, don’t forget to take your investments out. There is a menu of investments that are available to you. Talk to your 401k provider about what is best for you and your goals. Everyone is different.” [watch the video here]

14. Make sure you have your emergency fund:

“Can you elaborate what an emergency fund is? An emergency fund is six to eight months worth of your essential expenses saved in a bank account or an asset that is easily transferred into cash. Your essential expenses is everything that your life depends on: food, your rent, mortgage, commute—you name it. Your essential expenses don’t include impulse shopping on Amazon, for example, so that’s good news. What you want to do before you start investing of any kind is to sit down and calculate how much money you are spending on essential expenses and save up to six to eight months of that in your emergency fund. That way, if s*** hits the fan and you lose your job or something like that, you don’t have to panic sell your investment assets because you have a safety net to rely on during the rainy day.” [watch the video here]

15. Stay in touch with your credit score:

“If you want to buy a nice house or a nice car, you are going to need a good credit score, so I’m going to give you some tips on how you can do this. Once you turn 18, get yourself a credit card and you’re going to be given a credit limit, which is how much you can spend in one month, so whatever your credit limit is, you only want to spend 30% of that and just always make sure to pay your credit card balance in full and on time every single month. I use the app Credit Karma to check my credit score.” [watch the video here]

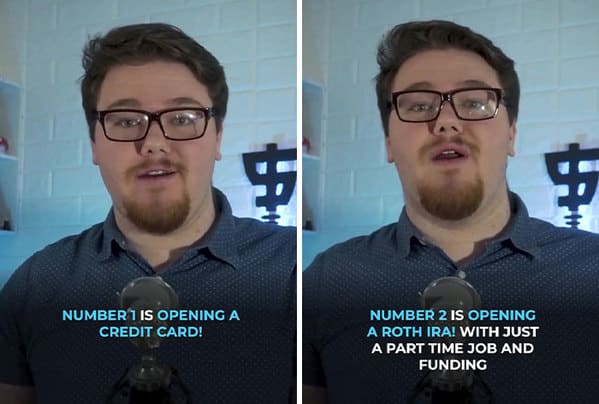

16. Open a Roth IRA and use it:

“Here are 3 things you should do as soon as you turn 18 in order to set yourself up for life. If you’re over 18, then do these things today! Welcome to @paydaypursuit—the show that explains important financial ideas and side hustles in under 60 seconds. Number 1 is opening a credit card. In episode 7, I talked about how important the age of your credit history is when determining your credit score, just never spend money you don’t have and pay it off in full every single month and you have a good credit score in no time. Number 2 is opening a Roth IRA! With just a part-time job and funding a Roth IRA with $360 every single month, you can literally set yourself up to be a millionaire. And lastly, number 3 is to invest in yourself! At 18, you have your whole life ahead of you. Use this time while you have a few bills and have a bit of money on things like books! One of my favorites is Rich Dad Poor Dad by Robert Kiyosaki! But I have a whole list of recommendations in my bio.” [watch the video here]

17. What should you do with spare money?

“This is another question I get a lot and this is my answer. If you’re not financially literate, you should invest in your financial literacy self-education first. That means you should read these 5 books. This is a solid foundation that will cost you less than a hundred bucks in understanding money and making money work for you and the wealth mindset. If you are financially literate and you’ve got some of that spare change, then I would naturally just put that into long-term investment. So if I had an extra 500 to $1,000 a month I would just dump that into one of my long-term assets. Maybe if I’m feeling it, I want to put into my Roth IRA in Acorns or I want to buy some crypto, maybe I want dollar cost averaging to a little extra BTC or ETH. To me, once you get financially literate, you won’t be asking questions like this anymore because you’ll know exactly what you want to do because you have the mindset and the game plan.” [watch the video here]

18. Know what to do with those store credit cards.

“-Thanks for shopping with us! Would you like to sign up for our credit card?

– Nah, I don’t shop here often.

-Are you sure? You’ll get rewarded every time you shop!

-Oh, I’m sure! The average interest rate of your credit card is typically twice that of an average card.

-OK, but what if we can extend you a credit limit of $100?

-That’s so low! If I actually signed up, that would bring down the average of my credit lines. Which could be bad for my credit!

-Okay, what store credit cards are actually good, then? Only places where I shop at all the time… and I’m always paying it off in full.” [watch the videohere]

19. Should you use a credit card or debit card?

“What’s the difference between a credit card and a debit card? When using a credit card, you’re kind of like borrowing money from the bank to purchase something, but you have to pay them back later. What about a debit card? When you use a debit card, you can only spend the amount that you have in your checking account. So which one should I use? I like using credit cards because it builds your credit, but you have to be responsible so you don’t get into credit card debt.” [watch the video here]

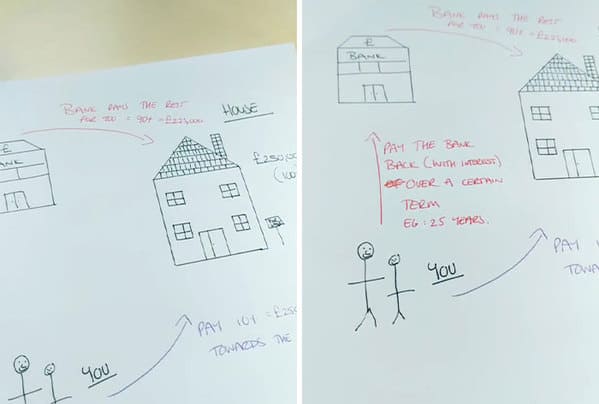

20. Learn about how mortgages work:

“What’s a mortgage in 15 seconds? This is you and you want to buy a house for 250,000 pounds, but you can’t afford it all right now. So you pay what you can towards the house and then you ask the bank to pay the rest of what you can’t pay right now. Then you pay the bank directly back what they’ve paid towards the house and then you own it outright.” [watch the video here]

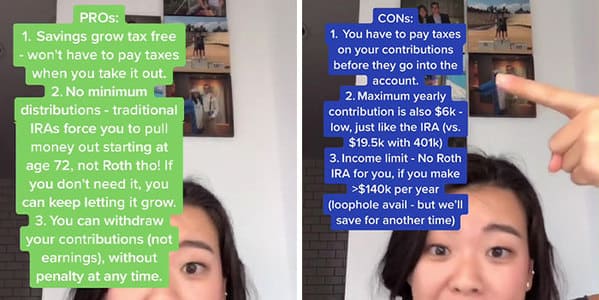

21. The pros and cons of opening an IRA:

“Roth IRA made easy! Roth individual retirement accounts are beloved in the retirement ecosystem, but just because it’s Roth doesn’t mean it’s right for everyone. There’s lots of benefits of Roth IRA accounts such as: your savings grow tax-free because everything you contribute is post-tax and you won’t have to pay taxes when you take it out, there’s no required minimum distribution, so if at 72, you don’t need this money, it can keep growing forever. And, you can withdraw your contributions, not your earnings, but your contributions, at any time without penalty. But cons include having to pay the taxes upfront, a low contribution limit of $6,000 a year just like a traditional IRA account and income limits! If you make $140,000 you can’t even have one of these. Roth IRAs are a great way to save for retirement especially if you’re new to the workforce. Follow me for more retirement, money, and getting rich.” [watch the video here]

22. And finally…How can you open up a Roth IRA?

“Here’s how to open a Roth IRA with Vanguard. First you’re going to go to investor.vanguard.com. Then you’re gonna click open an account. That will bring you here and you click let’s open my account. You will be asked how you want to fund your Roth and here we are going to click the first one. After that, you will select that you are new here and that will bring you to this page and you simply press continue. This asks why are we investing. We’re going to click retirement and the account type will be Roth IRA. Here’s a survey asking for the objective of your Roth, I’m gonna click growth and capital preservation and the source of funds is going to come from salary. Here you’re gonna put your personal information step two, you’ll enter your bank information, you review and sign and then sign up for access.” [watch the video here]